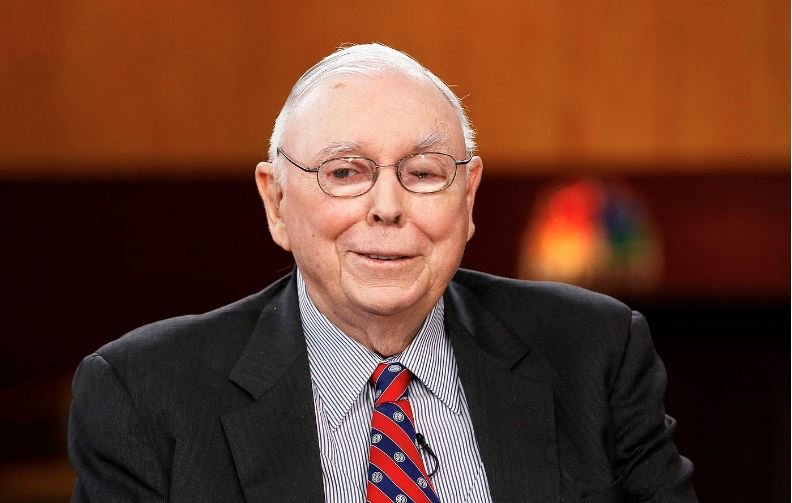

Unraveling the Genius of Charlie Munger: A Journey into the Mind of Warren Buffett’s Right-Hand Man

Introduction

In the vast landscape of investing, few figures stand as tall and revered as Charlie Munger. Often overshadowed by his long-time business partner Warren Buffett, Munger’s influence and wisdom are undeniable. In this blog, we embark on a journey to understand the man behind the success, exploring his life, principles, and the invaluable lessons he imparts.

Who is Charlie Munger?

Charlie Munger, born on January 1, 1924, in Omaha, Nebraska, is more than just a vice chairman at Berkshire Hathaway. His influence extends beyond the world of finance, reaching into the realms of psychology, philosophy, and decision-making. Munger’s intellectual prowess has earned him a reputation as a polymath, and his contributions to the field of investing are nothing short of legendary.

Munger’s Early Years

Charlie Munger’s journey began in a modest household during the Great Depression. Raised by a single mother after his father’s early death, Munger learned the value of resilience and resourcefulness from a young age. Despite facing financial challenges, he exhibited a keen intellect that would later shape his success.

Educational Pursuits

Munger’s academic journey took him to the University of Michigan, where he studied mathematics. However, his insatiable curiosity led him to the Harvard Law School. The intersection of law and finance laid the foundation for Munger’s multidisciplinary approach to investing. It wasn’t just about numbers; it was about understanding the broader context.

The Munger-Buffett Connection

The fateful meeting between Charlie Munger and Warren Buffett in 1959 marked the beginning of one of the most successful partnerships in the business world. The duo shared a common vision and a commitment to ethical investing. Munger’s influence played a pivotal role in shaping the investment philosophy of Berkshire Hathaway.

Investing Principles

1. The Power of Diversification:

Munger advocates for a well-diversified portfolio to mitigate risk. He believes in avoiding over-concentration in a single investment, emphasizing the importance of spreading risk across different assets.

2. Circle of Competence:

Munger stresses the significance of staying within one’s circle of competence. Understanding the businesses you invest in is crucial for making informed decisions. He advises against venturing into areas where you lack expertise.

3. Long-Term Perspective:

Unlike the short-term mindset prevalent in the market, Munger is a proponent of long-term investing. He believes in holding onto quality investments and letting them grow over time.

4. Rational Decision-Making:

Munger is a strong advocate for rationality. He encourages investors to make decisions based on logic and sound reasoning rather than emotions. Embracing a rational mindset can lead to better investment outcomes.

Life Lessons from Munger

Beyond the world of finance, Charlie Munger imparts valuable life lessons that extend to personal development and decision-making.

1. Continuous Learning:

Munger’s personal library is a testament to his commitment to lifelong learning. He advocates for the acquisition of diverse knowledge, emphasizing that a broad mental model enhances decision-making.

2. Invert, Always Invert:

The concept of inversion, flipping a problem to look at it backward, is a recurring theme in Munger’s speeches. By considering the opposite of what you want to achieve, you gain a fresh perspective and uncover potential pitfalls.

3. Integrity and Ethics:

Munger places a high premium on integrity and ethical behavior. He believes that success achieved through dishonest means is ultimately hollow. Upholding ethical standards is not only a moral imperative but also a strategic advantage in the long run.

FAQs about Charlie Munger

Q1: What is Charlie Munger’s Net Worth?

As of my last knowledge update in January 2022, Charlie Munger’s net worth was estimated to be around $2.2 billion. It’s important to note that net worth can fluctuate due to changes in the value of investments and other financial factors.

Q2: How Did Charlie Munger Meet Warren Buffett?

Charlie Munger met Warren Buffett in 1959 through a mutual acquaintance. The two connected over their shared values and investment philosophy. This meeting marked the beginning of a lifelong partnership that significantly impacted the world of finance.

Q3: What Books Does Charlie Munger Recommend?

Charlie Munger is known for his extensive reading habits. Some of the books he has recommended include “Influence: The Psychology of Persuasion” by Robert B. Cialdini, “The Third Chimpanzee” by Jared Diamond, and “Deep Simplicity” by John Gribbin. These books offer insights into psychology, human behavior, and complex systems.

Q4: What is Charlie Munger’s Approach to Decision-Making?

Charlie Munger’s approach to decision-making is rooted in rationality and a multidisciplinary mindset. He emphasizes the importance of considering a broad range of factors, avoiding emotional biases, and making decisions based on sound logic.

Q5: What Can Investors Learn from Charlie Munger?

Investors can learn several valuable lessons from Charlie Munger, including the importance of diversification, staying within one’s circle of competence, adopting a long-term perspective, and making rational decisions. His emphasis on continuous learning and ethical behavior also holds relevance for investors.

Conclusion

Charlie Munger’s impact on the world of investing and beyond is a testament to the power of intellect, principles, and lifelong learning. As we celebrate his contributions on this occasion of his 1-year birthday, let us continue to draw inspiration from the wisdom of this remarkable individual. Whether you’re navigating the complexities of the stock market or seeking guidance in life, the principles of Charlie Munger offer a guiding light in an ever-changing world.

READ MORE OUR TOP RANKING ARTICLES :

- What Is a Debt Warrant, and Why You Should Care : Top 5 secrets

- 7 Best Personal Injury Lawyer Memphis beyourvoice.com

- 12 Best Personal Injury Lawyer Kansas City langdonemison.com

- AutoTempest Car Dealer : 1 of The best in USA

- Personal Injury Attorney : U.S.A Best 20 Solutions

- Experian Freeze Credit Report : 31% Americans Don’t Know Their credit score

- Insurance Policies : Everyone Should Acclaim 5 policies

- Student Loan Relief assured for Borrower’s Debt announced by President Biden : 2023

- Personal Loan Basics Assurance : Authentic Article with 5 Points

- Better Mortgage Review

- President Biden Announces Student Loan Relief for Borrowers Who Need It Mos

- How To Choose the Right Long-Term Savings Account

- Mezzanine Financing: Best 3 ways to know

- Personal Loan Basics

- What is 5 Interest in Bank?

Visit Our WEBSITE : https://loaninsurancefinance.com/

Click Here : How To Choose the Right Long-Term Savings Account

USA official website : https://www.usa.gov/

I have been absent for some time, but now I remember why I used to love this web site. Thanks , I will try and check back more often.

Thank you. You are a humble person. Keep reading my new article. https://loaninsurancefinance.com/home-insurance-usa/

Thanks for the insightful article. It’s been packed with information , and delivered a lot of useful information.

Thank you. You are a humble person. Keep reading my new article. https://loaninsurancefinance.com/home-insurance-usa/